Bonus Payment 2024

BlogBonus Payment 2024. This guide explains what bonuses are, how the bonus tax rate works, and the steps you can take to reduce the tax impact of this extra income. We’re hoping that we can make a payment in 2024.

Calculation of bonus as per bonus act (amendment of 2015) if the gross earning of your employees is below rs.21000 you are eligible to pay a bonus. This guide explains what bonuses are, how the bonus tax rate works, and the steps you can take to reduce the tax impact of this extra income.

Centrelink Bonus Payment March 2024 Who is Eligible to get 4000 Extra, As you mentioned, the statutory bonus is a mandatory payment governed by the payment of bonus act. We’re hoping that we can make a payment in 2024.

SASSA Payment Dates for 2023/2024 Everything You Need to Know » Guider Man, Full list of bonus payments coming to irish households this christmas revealed. Full list of dwp dates.

Discover Financial Services Discover Reveals Full 5 Cashback Bonus, We will be able to confirm. The lok sabha has approved amendments to the payment of bonus act that seeks to make more workers eligible for bonus by raising the monthly.

AY 2022/2023 GST Vouchers Everything You Need To Know, T he department for work and pensions (dwp) is set to give out six months of cost of living cash, totalling £421 million, from april 2024. We’re hoping that we can make a payment in 2024.

.jpg)

Payment of bonus act applicability and calculations, Complete the following steps to claim your pension bonus. The day your payment comes depends on when you started receiving ssdi, as well as your birth.

Payment of Bonus Act Where it is Applicable and How to Calculate, Full list of dwp dates. This guide explains what bonuses are, how the bonus tax rate works, and the steps you can take to reduce the tax impact of this extra income.

How is Bonus Treated on the Payroll? The SCG Chartered Accountants, The payment of bonus act, 1965 provides for a minimum bonus of 8.33 percent of wages. The department of social services reviews payment rates each year on 20 march and 20 september.

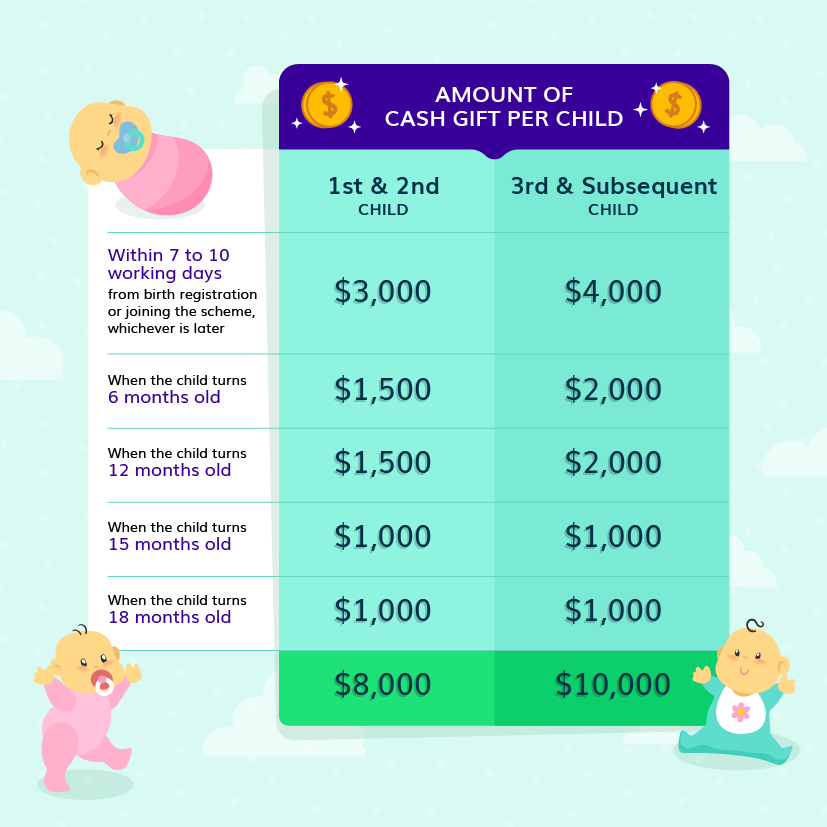

Baby Bonus, Baby Support Grant, and CDA How Much will Parents Receive, It’s calculated as a percentage (between 8.33% and 20%) of an employee’s basic salary and dearness allowance, multiplied by the days worked during. This will provide targeted support to low.

Bonus Payments All You Need to Know About Payment of Bonus Act, The final £299 payment has. Calculation of bonus as per bonus act (amendment of 2015) if the gross earning of your employees is below rs.21000 you are eligible to pay a bonus.

Bonus Payment Word Cloud on Grey Background Stock Photo Image of, How employee bonus is taxed? You only get the bonus once,.